Doing Business in Sri Lanka

With a focus on innovation, sustainability, and smart development, Sri Lanka is actively fostering an ecosystem that supports tech-driven industries, future-ready infrastructure, and global trade connectivity.

A Strategic Gateway for Business and Investment Growth

Doing business in Sri Lanka offers a unique blend of strategic location, investor-friendly policies, and a rapidly evolving economic landscape. Positioned at the crossroads of major shipping routes in the Indian Ocean, the country serves as a gateway to South Asia and beyond. Sri Lanka provides a competitive business environment with tax incentives, free trade zones, and strong government support for foreign direct investment. A skilled, English-speaking workforce and improving infrastructure further enhance its appeal, making it an attractive destination for businesses seeking regional growth and global connectivity.

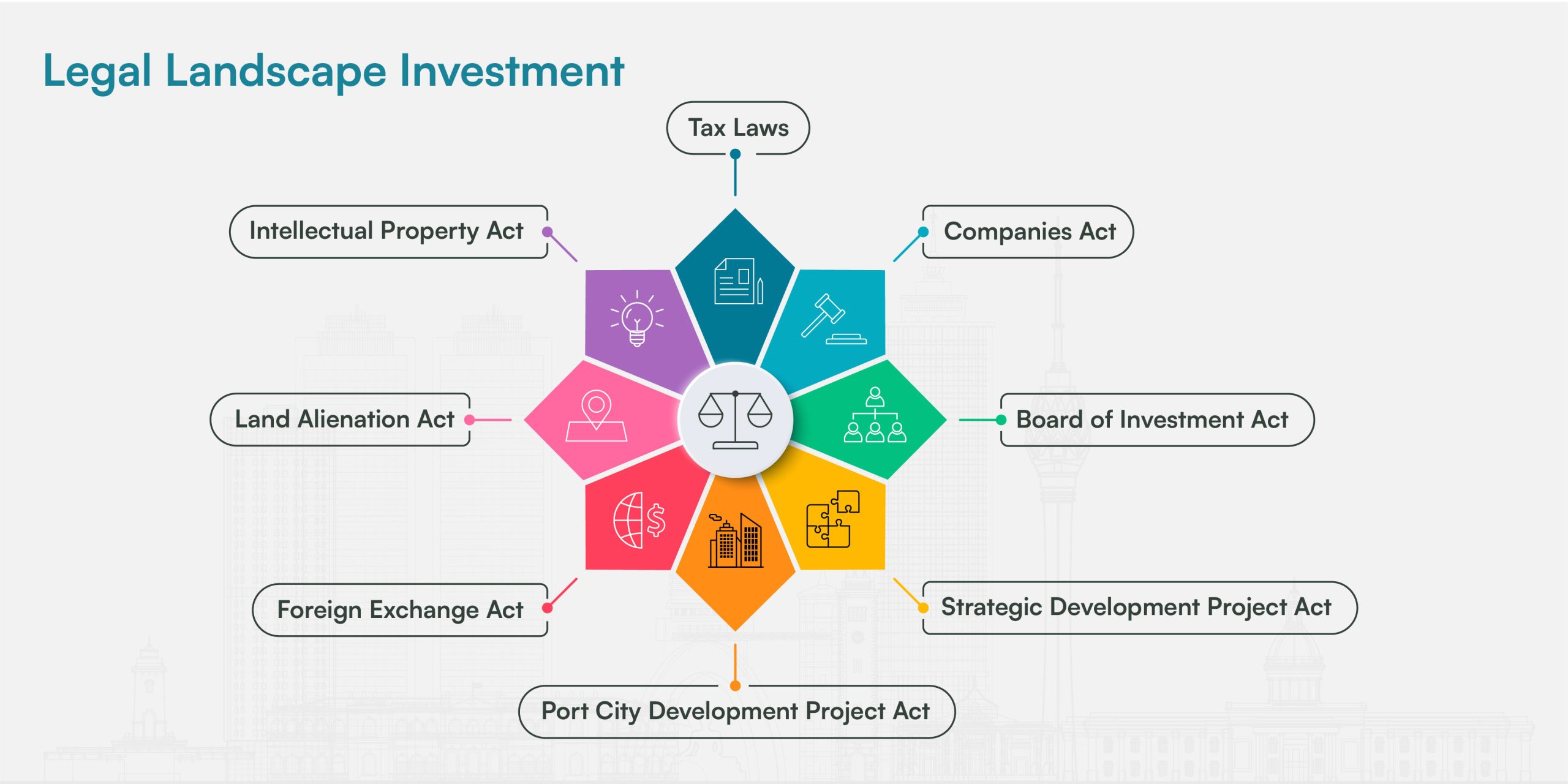

Laws Applicable for Investments in Sri Lanka

A well-established legal framework governs investment activity in Sri Lanka, offering clarity and protection to investors. Key legislation includes the Companies Act, BOI Act, Strategic Development Projects Act, and the Port City Development Project Act. Additional laws related to foreign exchange, land ownership, taxation, intellectual property, labor, immigration, and arbitration further ensure legal certainty and compliance for both local and foreign investors.

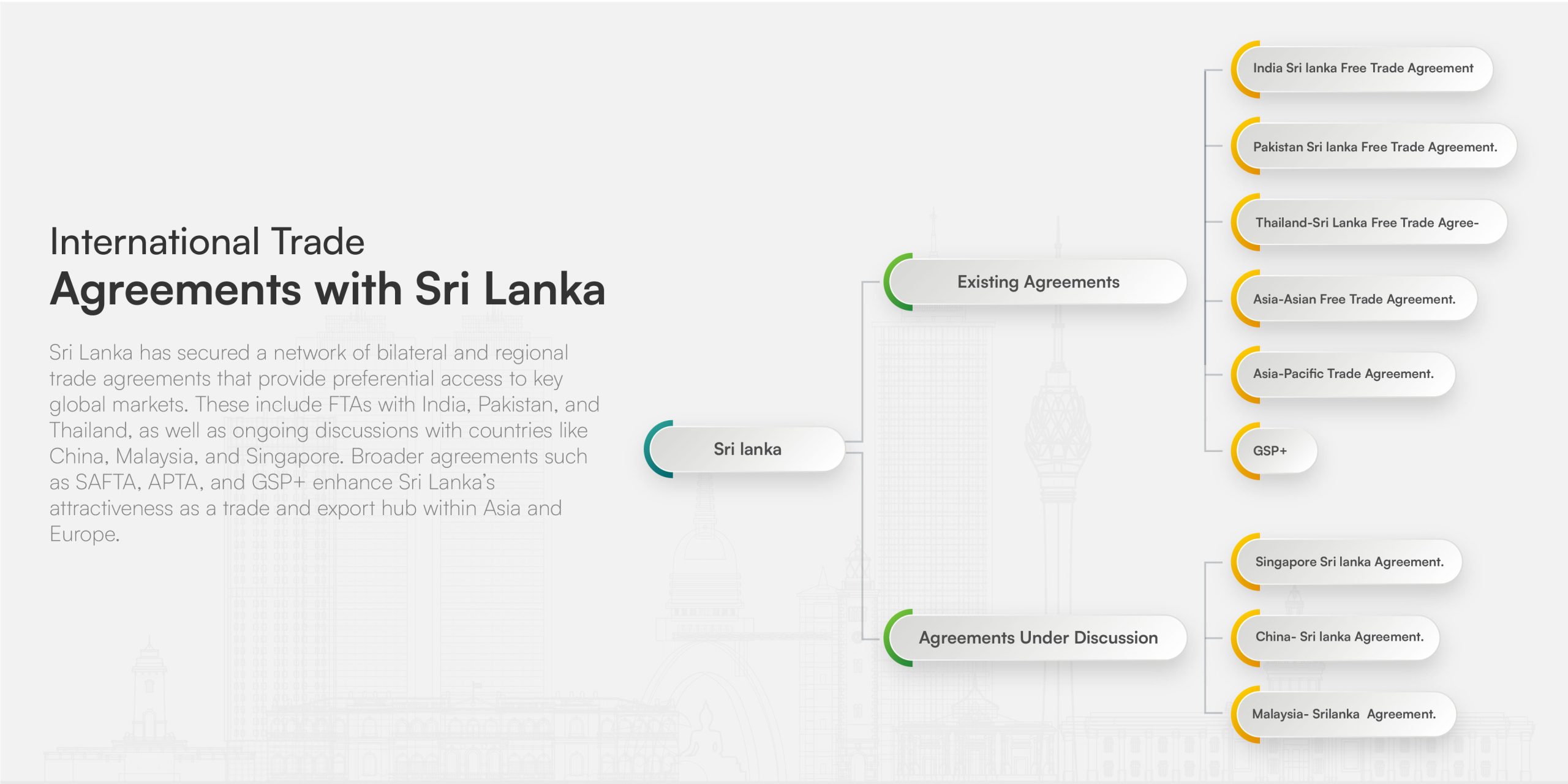

International Trade Agreements with Sri Lanka

Sri Lanka has secured a network of bilateral and regional trade agreements that provide preferential access to key global markets. These include FTAs with India, Pakistan, and Thailand, as well as ongoing discussions with countries like China, Malaysia, and Singapore. Broader agreements such as SAFTA, APTA, and GSP+ enhance Sri Lanka’s attractiveness as a trade and export hub within Asia and Europe.

Investor Protection

Investors in Sri Lanka are assured of strong protections, both constitutionally and through international treaties. The Constitution guarantees non-discriminatory treatment and lawful handling of investments, while Bilateral Investment Promotion and Protection Agreements (BIPAs) with several countries ensure additional safeguards, including fair treatment, dispute resolution mechanisms, and protection from expropriation.

From Concept to Completion – We’re With You

At DPR, we offer a full spectrum of services designed to support entrepreneurs, investors, and businesses at every stage of their journey. From validating your business idea to securing government approvals, managing operations, and resolving disputes, our specialized centers provide tailored solutions to ensure your venture thrives in Sri Lanka’s dynamic economic landscape.

Invest in Sri Lanka with confidence—choose the right advisor and secure your future success.

With over 25 years of experience providing investment-related services to foreign and local investors, we have witnessed numerous problematic situations encountered by foreign investors in Sri Lanka.

DPR’s team comprises Chartered Secretaries, Chartered Tax Advisors, Chartered Accountants, Attorneys-at-Law, IP Lawyers, Arbitrators, and HR professionals. Qualifications alone are not sufficient; continuous professional development is crucial. Therefore, DPR has implemented a policy requiring all team members to pursue ongoing professional education and continuous professional development.

OUR VALUES

At DPR, our values are rooted in integrity, transparency, and strategic foresight. We uphold the highest standards of corporate governance and legal compliance, ensuring that every decision aligns with regulatory frameworks and ethical business practices.

WHY CHOOSE US

DPR is committed to excellence, reliability, and long-term success. Our team brings industry expertise, innovative solutions, and a client focused approach to every project.

Contact Us for all of your investment needs